My Experience with Obamacare

A few weeks ago I wrote about working with patient advocates…

While my patient advocate session was focused on Medicaid, my personal experience with Obamacare is in a different health care system, if you will, because I run a “micro-business” (fewer than 10 people) and I buy an individual policy “off-Exchange.”

My income is above 400% of the Federal Poverty Level (FPL) so I don’t receive any assistance to buy the insurance, i.e., pay the premium, nor do I receive any assistance with copays, etc. (the cutoff for cost-sharing help is 200% of FPL). Personally, I feel I make enough money to pay for insurance, and I do worry about getting into a car accident or receiving a life-changing diagnosis, so I choose to buy health insurance every year.

Even still, the patchwork system that has been built is truly not designed for someone like me. I am lucky enough to have few health problems. I fill a prescription less than once a year and when I do, it’s usually for some kind of travel-related thing, like malaria prevention. I am not writing this to brag, but simply to say, I don’t “need” health insurance other than the way I “need” homeowner’s insurance. I am insuring myself against something terrible happening. If I pay $12,000 a year in premiums, I expect I will receive no value from that expense each year except peace of mind. For some people, they do “need” health insurance because they have health care needs they could not afford to manage without that insurance.

Should the person with health care needs pay more for insurance than I pay? Well, they already do, because even if we pay the same amount in monthly premiums, they certainly pay more in deductibles, copays, and any other cost-sharing than I do because they use health care services that require those payments. The essence of insurance, whether car, home, fire, or health, is that more people pay premiums than incur claims. I am buying protection against a possible eventuality. For people with health care needs, health services aren’t an eventuality, they are a reality. That’s what insurance is for.

But the other important question is whether my purchase of insurance should be tax-advantaged in some way. I mentioned above that some people are eligible to receive tax-payer supported health insurance or health care – either because they qualify for Medicaid or because they have an income low enough to allow them to buy insurance in the Exchanges.

Should my purchase of health insurance be tax advantaged because of my job status? How about because I am an employer? That may seem an odd question, but as most of this blog’s readers know, the employer-sponsored insurance (ESI) tax exclusion is the single largest tax break in the nation. It is also worth more to people who earn more income. The Tax Policy Center estimates the “ESI exclusion costs the federal government an estimated $260 billion in income and payroll taxes in 2017.” (For comparison, the mortgage interest deduction was worth about $70 billion).

So despite my income and work status, I am eligible for tax-advantaged health insurance after all! But the patchwork nature of the U.S. health insurance system rears its ugly head again because it turns out, it’s cheaper for me to buy health insurance in the individual market (and to help my employees do the same), than it is for me to buy in the small group market. The choice is to access the tax deduction, but pay more for insurance for me and everyone in my company, or buy a plan in the individual market and pay less.

As ZaneBenefits explains, “for the majority of small groups, individual health insurance is more affordable than group health insurance because of the size of the risk pool…With a group health insurance plan if one employee has a baby, a surgery, or is diagnosed with a chronic illness, [the business is] likely to see a large premium rate increase at annual renewal time.”

Part of the debate about repealing and replacing Obamacare concerns patients with high health care needs who could lose access to care, as we have blogged about previously. However, part of the debate is also about the premium increases being seen by small businesses (and other entities as well). Members of the National Federation of Independent Business (NFIB), which represents small businesses, “have reported “The Cost of Healthcare” as the #1 problem for small businesses in Small Business Problems & Priorities since 1986.”

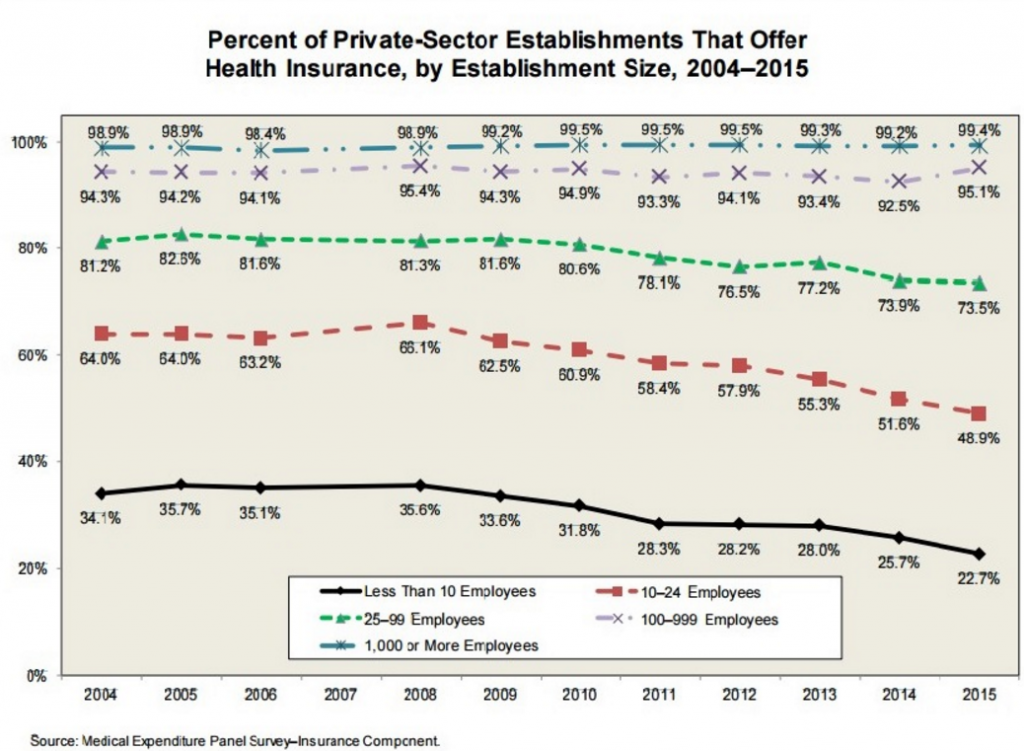

To be graphic, it has led to this:

The chart above from the Society for Health Resource Managers (SHRM) shows the stability of health insurance offering rates by large employers, compared to four smaller employer sizes. Notably, the smallest employer size (10 employees or fewer) represented by the black line at the bottom of the chart, has decreased by the largest percentage (36%).

My personal experience of Obamacare is a mixed bag. On the one hand, because of Obamacare it is much easier for me to buy insurance for myself as a small business owner than it was before the law passed. On the other hand, as an employer, the regulatory burden of and cost of trying to provide insurance coverage to my employees has proven to be too much for our small company to handle. Even with Obamacare, we, as a small business, are at a fundamental disadvantage when it comes to offering support for employees who want to buy health insurance.

Small businesses, defined by the Small Business Administration as those with fewer than 500 employees, comprise 99.7% of firms with paid employees, and employ 48% of private sector employees. Paying more attention to what needs to be fixed in Obamacare based on the needs of small businesses, in addition to focusing on the needs of those with serious health care needs, could lead us to more productive solutions than have been on offer recently.

There are multiple health insurance systems operating in the U.S. We either have to agree we are only going to try to tackle a couple of pieces, or we have to be more transparent about what happens if we make changes to the system that benefit someone like me (low health care needs, high premiums) or to benefit someone like the patient advocates (high health care needs, supported by tax dollars). I wouldn’t mind a little more attention being paid to small business concerns either!

Leave A Comment